BLOGS

04 Aug 2025

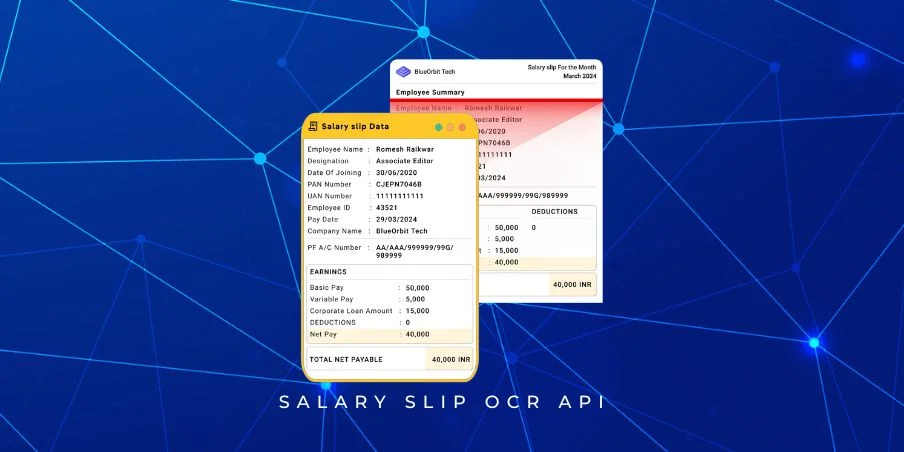

Salary Slip OCR API for Fast Employee Onboarding

Salary Slip OCR API is transforming how HR and onboarding systems process employee income documents. As companies increasingly shift to digital-first and remote hiring, the pressure on HR and fintech platforms to streamline verification workflows has never been higher. One of the most tedious and error-prone steps in the employee onboarding journey is manually reviewing salary slips — a process that doesn’t scale well in high-volume environments. Whether you’re verifying income for employment, credit eligibility, or financial onboarding, manual data entry leads to inefficiencies, delays, and a higher risk of human error.

To meet these demands, automated OCR (Optical Character Recognition) solutions have emerged as a powerful tool to extract structured data from payslips. The Salary Slip OCR API provides a standardized, scalable way to parse critical salary components — such as basic pay, net pay, bank account details, and tax identifiers — directly from uploaded documents, enabling faster and more reliable decision-making.

This blog will explore how HR tech developers, digital onboarding platforms, and credit/KYC providers can integrate this technology to automate income verification. We’ll break down how it works, key benefits, real-world use cases, compliance considerations, and what the future holds for OCR in the HR and fintech ecosystem.

What Is a Salary Slip OCR API?

Salary Slip OCR API uses advanced Optical Character Recognition (OCR) technology to automatically extract structured data from scanned or uploaded salary slips. OCR is an AI-powered method that reads and digitizes text from images or PDF documents — converting unstructured visual content into machine-readable formats like JSON.

While salary slips are generally structured, they often vary across organizations in terms of layout, language, format (PDF, JPG, PNG), and field labels. This variability makes manual data extraction both error-prone and inefficient. A Salary Slip OCR API solves this by intelligently parsing salary documents and extracting key fields needed for HR and financial decision-making.

Key Fields Typically Extracted:

- Full Name

- Designation

- Company Name

- Address

- Date of Joining

- PAN Number

- UAN Number

- Bank Account Number

- Basic Pay

- Variable Pay

- Corporate Loan Amount

- Net Pay

- Currency

- Salary Month

- Salary Year

By using a Salary Slip OCR API, platforms can skip manual review processes and instantly extract all this information into a clean, structured format.

Why Fast and Accurate Payslip Processing Matters

In today’s digital-first hiring and lending environment, speed and accuracy in processing salary slips are no longer optional — they’re essential. Whether you’re an HR team trying to roll out offer letters faster, or a fintech company assessing a customer’s income eligibility, manual review processes just don’t scale.

For HR Teams: Faster onboarding through automated payslip extraction enables quicker offer rollouts. It also reduces administrative workload by eliminating the need for manual copy-pasting from scanned documents.

For Fintech Platforms: Income verification becomes instant, supporting seamless journeys for credit cards, personal loans, and BNPL offerings. Structured salary data improves the accuracy of risk and eligibility models.

For Compliance Teams: Payslip OCR ensures standardized documentation across varying formats, making it easier to maintain consistency. It also simplifies audits by producing machine-readable, traceable records.

The Problem with Manual Payslip Review: Manual processes are slow and error-prone. Companies face challenges such as inconsistent payslip formats, human errors in reading amounts or deductions, and verification delays due to backlog or limited review capacity.

The Salary Slip OCR API helps resolve these challenges by delivering a scalable, accurate, and automated alternative to manual payslip review.

Key Benefits of Using a Salary Slip OCR API

Speed and Automation: A Salary Slip OCR API can process thousands of salary slips in just minutes, eliminating the bottleneck caused by manual data entry. This removes the dependency on HR reviewers and accelerates onboarding workflows significantly.

Accuracy: With built-in confidence scoring and field-level validation, the API ensures high data accuracy. It can also flag mismatches between declared and extracted information, helping HR and compliance teams catch discrepancies early.

Scalability: Whether you’re a startup building an onboarding tool or a large enterprise integrating with an HRMS, the API is designed to scale. It supports batch processing and webhook-based updates for seamless automation.

Cost Efficiency: Automating payslip extraction reduces the need for manual HR manpower, which in turn lowers operational costs. Faster document approval also helps meet SLAs more effectively.

User Experience: Candidates receive real-time feedback during the document submission process, resulting in a smoother and more transparent customer onboarding experience.

How Salary Slip OCR API Works

Input: The process begins when a user uploads a salary slip in image or document format — typically JPG, PNG, or PDF. This file is sent to the API through a request, optionally accompanied by metadata such as employee ID or application reference number.

Processing: Once received, the OCR engine reads the visual content of the payslip and identifies characters, numbers, and labels. Machine learning models then analyze the layout and map the extracted data into structured key-value fields like basic pay, net pay, UAN number, and more.

Output: The API returns clean JSON data that includes all extracted fields along with confidence scores indicating the reliability of each value. Fields with low confidence can be flagged for manual review, providing a built-in fallback for edge cases or unclear inputs.

Integration for HR and Onboarding Platforms

The Salary Slip OCR API can be seamlessly integrated into digital onboarding workflows to automate income verification. Platforms can embed it directly into onboarding forms to extract and validate compensation details in real-time.

Common use cases include offer letter validation, compensation benchmarking, and employment history verification. These help reduce friction for both HR teams and candidates, improving the overall onboarding experience.

The API supports popular backend stacks like Node.js, Python (Flask or Django), and Java, making it easy to adopt across various tech environments. Integration options include a standard REST API, webhooks for event-driven updates, and even on-premise or VPC deployments for enterprise clients with data residency or security requirements.

For optimal performance, it’s recommended to use asynchronous processing through task queues like Celery or RabbitMQ. This allows scalable handling of bulk uploads while ensuring responsive UI interactions. Additionally, platforms can include an admin override feature to manually review or correct fields that fall below a certain confidence threshold.

Compliance and Data Privacy

Salary slips contain sensitive personal and financial information, making data privacy and regulatory compliance absolutely critical when processing them through an OCR API.

A robust Salary Slip OCR API should adhere to industry-leading security and privacy standards. This includes GDPR-compliant data handling, ensuring that user data is processed lawfully, transparently, and only for its intended purpose.

Security best practices such as encryption at rest and in transit (e.g., AES-256 and TLS 1.2+) are essential to protect data from unauthorized access. An effective API should also implement auto-deletion policies, automatically purging processed data within 24–48 hours to minimize retention risks.

Access controls are equally important. Features like IP whitelisting, role-based access control (RBAC), and detailed audit logs help organizations maintain visibility and enforce strict data governance.

For enterprise clients with advanced security needs, options such as private API endpoints or on-premise/VPC deployment offer additional control over infrastructure and data locality.

By prioritizing privacy and compliance, the Salary Slip OCR API ensures trust, transparency, and security at every step of the document processing pipeline.

Real-World Use Cases

HR Platforms: Salary Slip OCR APIs help automate employee record verification during onboarding. They’re especially effective for bulk hiring scenarios, such as onboarding gig workers or contractual staff, where manual document checks become unmanageable.

Fintech & Lending: Lenders can use the API to instantly validate income details from payslips during personal loan or credit card applications. It can also be used to cross-verify salary credits against bank statements for stronger income authentication.

B2B Payroll SaaS: Payroll software providers can embed the API to reduce document review burdens on their client admins. It can be integrated directly into payroll approval workflows to streamline salary processing and compliance checks.

Recruitment Agencies: Agencies conducting background checks can automate CTC (Cost to Company) verification by extracting structured data from submitted payslips. This improves the speed and reliability of candidate evaluations.

Performance Metrics and Benchmarks

A high-performing Salary Slip OCR API is designed to deliver both speed and accuracy at scale. On average, the API processes a salary slip in just 1 to 2 seconds per document, making it suitable for real-time onboarding and verification workflows.

In terms of accuracy, key fields like net salary and pay period/date fields consistently achieve up to 99.4% precision, ensuring reliable extraction across a wide variety of document formats and layouts. These metrics are backed by continuous model training and validation against diverse slip formats.

The API supports a wide range of file types, including JPEG, PNG, and PDF — whether scanned copies or digitally generated files — ensuring flexibility for users and platforms.

For production-grade deployments, the system offers a 99.9% uptime guarantee, ensuring high availability even during peak usage. Additionally, SLA-backed response times, such as sub-1 second latency for standard requests, help maintain a seamless user experience across integration points.

Developer Tips and Best Practices

Integrating a Salary Slip OCR API? Here are some smart ways to ensure smooth performance and high accuracy from day one:

- Keep it light: Compress images before sending them to the API. Smaller files mean faster uploads and quicker results.

- Stick to structure: Whenever possible, use consistent templates or formats for payslips. Clean, well-aligned data improves extraction quality.

- Don’t trust blindly: Set confidence thresholds. If the API flags something as uncertain, route it to a human reviewer automatically.

- Go bulk when needed: Need to process 50 or 5,000 documents? Use batch upload features (like ZIP support) to simplify your workflow.

- Plan for errors: Handle key response codes gracefully:

- 400: Something’s wrong with the file.

- 401: Your request isn’t authorized — check your token or key.

- 422: The API couldn’t confidently extract key fields.

- Cache smartly: Already processed that slip? Save the results. Avoid unnecessary repeat calls and save on compute time.

A little planning goes a long way. With these practices, your integration will run smoother and scale effortlessly as your platform grows.

Future Trends in Salary Document Automation

The landscape of salary slip processing is rapidly evolving. As HR tech and fintech platforms mature, new innovations are shaping the next generation of document automation:

- Multilingual OCR: Expanding support for regional salary slips in languages like Hindi, Tamil, Bengali, and more — unlocking OCR for India’s diverse workforce.

- AI-powered fraud detection: Advanced algorithms can now flag forged or tampered payslips by spotting inconsistencies in fonts, layouts, and metadata.

- Document triangulation: Platforms are beginning to cross-verify salary data with bank statements, Form-16s, and even offer letters — improving trust and decision quality.

- Real-time decisioning APIs: By layering business rules over OCR outputs, platforms can now deliver instant verdicts on creditworthiness, employment proof, or eligibility.

- Embedded OCR experiences: SDKs and mobile-first OCR tools are bringing document scanning directly into onboarding flows, reducing friction and improving user experience.

As these trends continue, Salary Slip OCR APIs will evolve from a backend utility into a key part of the intelligent onboarding stack — helping businesses move faster, smarter, and more securely.

Conclusion

Salary Slip OCR APIs are redefining how HR, fintech, and onboarding platforms handle employee income documents. By automating the extraction and validation of key salary data, these APIs deliver:

- Faster onboarding and offer rollouts

- More accurate and consistent document processing

- Secure, compliant workflows that scale with demand

For developers and HR tech leaders, integrating a Salary Slip OCR API isn’t just a technical upgrade. It’s a strategic move. It brings operational efficiency to your teams while significantly improving the experience for candidates and customers.

As digital hiring and verification continue to grow. Platforms that embrace intelligent automation will stay ahead — both in speed and in trust.

FAQs

1. What is a Salary Slip OCR API and how does it work in LSIS?

Ans: A Salary Slip OCR API is a tool powered by Optical Character Recognition and machine learning that extracts structured data from salary slips in image or PDF formats. In LSIS workflows, it helps automatically capture key details like net pay, employer name, pay period, and deductions without manual intervention.

2. Why should we use a Salary Slip OCR API instead of manual data entry?

Ans: Manual review of salary slips is time-consuming and error-prone, especially when formats vary across companies. A Salary Slip OCR API automates this process, reducing turnaround time, eliminating human error, and improving the accuracy and speed of LSIS-driven decisions like loan eligibility or onboarding clearance.

3. What fields can the Salary Slip OCR API extract for LSIS integration?

Ans: The API can extract essential fields including Full Name, Company Name, Address, Designation, Date of Joining, PAN Number, UAN Number, Bank Account Number, Basic Pay, Variable Pay, Corporate Loan Amount, Net Pay, Currency, Salary Month, and Salary Year. This ensures LSIS has a complete financial and employment picture.

4. How accurate is the Salary Slip OCR API for LSIS use cases?

Ans: Advanced APIs offer up to 99.4% field-level accuracy for critical data points like Net Pay and Pay Period. These high accuracy rates reduce the need for manual corrections, making LSIS applications faster and more reliable for income verification, background checks, and onboarding.

5. Is the Salary Slip OCR API secure and compliant for financial and HR data?

Ans: Yes, reliable APIs are GDPR-compliant and follow industry standards for security. This includes data encryption in transit and at rest (TLS 1.2+, AES-256), role-based access controls, audit logs, and automatic data deletion after processing. LSIS platforms handling personal and financial data benefit from these built-in safeguards.

6. Can the API handle regional and multilingual salary slips common in LSIS workflows in India?

Ans: Yes, many APIs are trained on diverse Indian formats and support multilingual OCR (e.g., English, Hindi, Tamil). This makes them suitable for LSIS platforms operating in varied geographic regions with different salary slip templates.

7. How do we integrate a Salary Slip OCR API into our HR or LSIS platform?

Ans: Integration is simple using RESTful API endpoints. Developers can make POST requests with image or PDF files and receive structured JSON output. Common stacks include Python (Flask/Django), Node.js, and Java. The API can be embedded into onboarding forms, background checks, or income verification pipelines in LSIS.

8. Does the API support batch processing and real-time use?

Ans: Yes, the Salary Slip OCR API can handle both use cases. For high volume processing, it supports batch uploads via zipped files or asynchronous task queues. For real-time LSIS workflows, such as instant eligibility checks, it delivers fast responses (1–2 seconds per document on average).

9. What happens if the extracted data has low confidence?

Ans: The API returns confidence scores with each field. If a field falls below a defined threshold, it can be flagged for manual review. This fallback system is critical for LSIS platforms that require precision but want to maintain automation at scale.

10. What are common errors to handle when using the Salary Slip OCR API in LSIS systems?

Ans: Typical errors include 400 for invalid file format, 401 for unauthorized access, and 422 for low-confidence data extraction. Developers should handle these gracefully in the LSIS UI and offer fallback steps like re-upload or manual verification.

11. How long is the salary slip data stored by the API?

Ans: Most APIs are designed to delete data automatically after processing (typically within 24–48 hours) to ensure privacy compliance. LSIS platforms can also request on-premise or private cloud deployment for full control over storage.

12. Is it suitable for both startups and large enterprises building LSIS tools?

Ans: Yes, the API scales easily. Startups can integrate it into lightweight onboarding apps, while enterprises can deploy it within their HRMS, payroll, or lending platforms with custom SLAs, VPC hosting, and bulk document processing support.